Use these links to rapidly review the document

Table of ContentsUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Statement

☐

Definitive Additional Materials

☐

Soliciting Material under §240.14a-12

The Simply Good Foods Company

| | |

Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

ý |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

o |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

(Name of Registrant as Specified In Its Charter)

| | | | |

The Simply Good Foods Company |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)Payment of Filing Fee (Check the appropriate box):

☒

No fee required.

☐

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)

Title of each class of securities to which transaction applies:

(2)

Aggregate number of securities to which transaction applies:

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)

Proposed maximum aggregate value of transaction:

(5)

Total fee paid:

☐

Fee paid previously with preliminary materials.

☐

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)

Amount Previously Paid:

(2)

Form, Schedule or Registration Statement No.:

(3)

Filing Party:

(4)

Date Filed:

NOTICE OF 20202021 ANNUAL MEETING OF STOCKHOLDERS December

[ · ], 201910, 2020

Dear Fellow Stockholders,

It is my pleasure to invite you to attend The Simply Good Foods Company's 2020Company’s 2021 Annual Meeting of Stockholders (the "Annual Meeting"“Annual Meeting”) on Wednesday,Thursday, January 22, 202021, 2021 at 9:00 a.m. (ET), at The Ritz-Carlton Golf Resort, 2600 Tiburon Drive, Naples, FL 34109.. In light of the coronavirus (COVID-19) outbreak, and to support the health and well-being of our directors, employees, stockholders, and other stakeholders, we have determined that the Annual Meeting will be held entirely online via audio webcast, with no physical in-person meeting. If you plan to participate in the Annual Meeting, please see the “General Information About the Annual Meeting and Voting” section in the attached proxy statement. Stockholders will be able to participate in, vote, view the list of stockholders of record and submit questions from any location via the internet by visiting www.virtualshareholdermeeting.com/SMPL2021. At the Annual Meeting, our stockholders will be asked: 1.

To elect the four Class IIII director nominees;

2.

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2020;2021;

3.

3.To consider and vote upon the advisory vote to approve the compensation of our named executive officers; and

4.

4.To consider and vote upon the advisory vote on the frequency of future advisory votes to approve the compensation of our named executive officers;

5.To approve an amendment of our Amended and Restated Certificate of Incorporation (the "Certificate") to declassify the Board of Directors;

6.To approve an amendment of the Certificate to eliminate the supermajority voting requirements; and

7.To transact such other business as may properly come before the Annual Meeting.

We know of no other matters to come before the Annual Meeting. Only stockholders of record at the close of business on November 25,

20192020 are entitled to notice of, and to vote at, the Annual Meeting. We have sent a Notice of Internet Availability of Proxy Materials to each of our stockholders, providing instructions on how to access our proxy materials and our

20192020 Annual Report on the Internet. Please read the enclosed information carefully before submitting your proxy.

The list of stockholders entitled to vote at the Annual Meeting will be available for examination 10 days prior to the Annual Meeting at our principal executive office, 1225 17th Street, Suite 1000, Denver, Colorado 80202. The list of stockholders will also be available during the Annual Meeting through www.virtualshareholdermeeting.com/SMPL2021 for those stockholders who choose to attend.

Your vote is important. Please note that if you hold your shares through a broker, your broker cannot vote your shares on the election of directors and certain other proposals in the absence of your specific instructions as to how to vote. In order for your vote to be counted, please make sure that you submit your vote to your broker.

We appreciate the confidence you have placed in us through your investment, and we look forward to seeing you at the Annual Meeting.

By Order of the Board of Directors, | | |

| | By Order of the Board of Directors, |

|

|

|

|

|

James M. Kilts

Chairman of the Board of Directors |

![[MISSING IMAGE: sg_jameskilts-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-20-133922/sg_jameskilts-bw.jpg)

James M. Kilts

Chairman of the Board of Directors

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 20202021 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JANUARY 22, 2020:21, 2021: Our Proxy Statement and Annual Report for the fiscal year ended August 31, 201929, 2020 are available atwww.proxyvote.com.

Table of Contents

TABLE OF CONTENTS

TABLE OF CONTENTS

| | | | Page | |

| | Page | |

|---|

| | | | | 1 | | |

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | | | | |

3 | | |

Information About Attending the Annual Meeting | | | | | 3 | | |

Information About this Proxy Statement | | | 3 | |

Information About Voting

| | | 4 | | |

| | | | | 4 | | |

| | | | | 5 | | |

| | | | | 5 | | |

Required Votes for Action to be Taken | | | | | 65 | | |

Other Business to be Considered | | | | | 6 | | |

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE | | | | |

76 | | |

| | | | | 6 | | |

| | | | | 6 | | |

| | | | | 7 | | |

Board of Directors Leadership Structure | | | | | 7 | | |

| | | 8 | |

Board Leadership Structure

| | | 8 | |

Annual Evaluations of the Board and Board Committees | | | | | 98 | | |

Review of Related Person Transactions | | | | | 98 | | |

Role of the Board in Risk Oversight | | | | | 109 | | |

Communications with the Board | | | | | 109 | | |

Process for Recommending or Nominating Potential Director Candidates | | | | | 109 | | |

Succession Planning and Management Development | | | | | 1211 | | |

Compensation Committee Interlocks and Insider Participation | | | | | 11 | | |

| | | | | 12 | | |

Anti-Hedging and Pledging Policy

| | | 13 | |

Code of Ethics | | | | | 1312 | | |

Director and Executive Officer Ownership Guidelines | | | | | 12 | | |

| | | | | 12 | | |

| | | | | 13 | | |

| | | | | 1413 | | |

| | |

15 | |

Director Compensation

| | | 15 | |

Outstanding Equity Awards at Fiscal-Year End | | | | | 1714 | | |

MEETINGS AND COMMITTEES OF THE BOARD | | | | |

1815 | | |

PROPOSAL ONE: ELECTION OF DIRECTORS | | | | |

2017 | | |

Class IIII Directors Standing for Re-Election or Being Nominated for Election | | | | | 2017 | | |

Directors Continuing in Office | | | | | 2319 | | |

Board of Directors Skills and Experience Chart | | | | | 2623 | | |

| | | | Page | |

PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF DELOITTE & TOUCHE LLP AS

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL

YEAR 20202021 | | | | |

2724 | | |

| | | | | 2724 | | |

Pre-Approval Policies and Procedures | | | | | 2825 | | |

| | | | |

3026 | |

i

Table of Contents

| | | | | |

| | Page | |

|---|

PROPOSAL THREE: ADVISORY VOTE TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS | | | | | 27 | | |

| | | | | 29 | | |

| | | | | 31 | | |

Executive SummaryPROPOSAL FOUR: ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

| | | | |

3331 | | |

PROPOSAL FIVE: APPROVAL OF AN AMENDMENT OF THE CERTIFICATE TO DECLASSIFY THE BOARD

| | |

34 | |

Background of Proposal

| | | 34 | |

Vote Required and Effectiveness

| | | 35 | |

Text of Proposal

| | | 35 | |

PROPOSAL SIX: APPROVAL OF THE AMENDMENT TO THE CERTIFICATE TO ELIMINATE THE SUPERMAJORITY VOTING REQUIREMENTS

| | |

36 | |

Background of Proposal

| | | 36 | |

Vote Required and Effectiveness

| | | 36 | |

Text of Proposal

| | | 37 | |

EXECUTIVE OFFICERS

| | |

38 | |

COMPENSATION DISCUSSION AND ANALYSIS

| | |

40 | |

Executive Summary

| | | 40 | |

Key Features of Fiscal Year 20192020 Executive Compensation Program | | | | | 4232 | | |

| | | | | 33 | | |

| | | | | 4233 | | |

| | | | | 4334 | | |

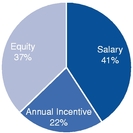

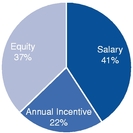

Fiscal Year 20192020 Compensation Elements & Philosophy | | | | | 4435 | | |

| | | | | 41 | | |

| | | | | 4942 | | |

| | | | | 43 | | |

| | | | | 5145 | | |

COMPENSATION COMMITTEE REPORT | | | | |

5246 | | |

Summary Compensation Table | | | | | 5347 | | |

Grants of Plan-Based Awards Table | | | | | 5448 | | |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards

Table | | | | | 5449 | | |

Outstanding Equity Awards at Fiscal Year-End | | | | | 5649 | | |

Option Exercises and Stock Vested Table | | | | | 5651 | | |

| | | | | 5751 | | |

Nonqualified Deferred Compensation | | | | | 5751 | | |

Potential Payments Upon Termination or Change in Control | | | | | 5751 | | |

| | | | | 55 | | |

| | | | | 6055 | | |

OWNERSHIP OF SIMPLY GOOD FOODS COMMON STOCK BY CERTAIN BENEFICIAL OWNERS | | | | |

6156 | | |

CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS | | | | |

6357 | | |

| | | | |

6559 | | |

Stockholder Proposals for the 20212022 Annual Meeting of Stockholders | | | | | 6559 | | |

Expenses of Soliciting Proxies | | | | | 6559 | | |

| | | | | 6559 | | |

| | | | | 6560 | | |

Appendix A—Declassification Proposal Amendment Language

| | | | |

Appendix B—Supermajority Voting Removal Proposal Amendment Language

| | | | |

Annex I—I – Non-GAAP Reconciliations | | | | | A-1 | | |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

PROXY STATEMENT SUMMARY

This summary highlights certain information contained elsewhere in this proxy statement. This is only a summary, so please refer to the Proxy Statement and the Annual Report for the fiscal year ended August 31, 201929, 2020 before you vote.

20202021 ANNUAL MEETING OF STOCKHOLDERS

| | | |

| Date and Time: | | | Place: | |

Wednesday, | Thursday, January 22, 2020,21, 2021, at 9:00 a.m. (ET) | | | www.virtualshareholdermeeting.com/SMPL2021. The 2021 Annual Meeting will be in virtual format only, via the internet, with no physical in-person meeting |

|

The Ritz-Carlton Golf Resort, 2600 Tiburon Drive, Naples, FL 34109 |

| Record Date: |

|

| | |

| November 25, 20192020 |

|

| | |

VOTING MATTERS AND BOARD RECOMMENDATIONS

| Proposal | | | | |

Proposal

| | Vote Required for Approval | | Board's | | | Board’s Recommendation | |

|---|

Election of the four Class IIII director nominees | | | A plurality of the votes cast (the four nominees receiving the highest number of "FOR"“FOR” votes cast will be elected) | | | FOR all director nominees | |

Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 20202021 |

|

| Majority of shares present in person, including by means of remote communication, or represented by proxy and entitled to vote |

|

| FOR | |

Advisory vote to approve the compensation of our named executive officers |

|

| Majority of shares present in person, including by means of remote communication, or represented by proxy and entitled to vote |

|

FOR |

Advisory vote to approve the frequency of future advisory votes to approve the compensation of our named executive officers |

FOR |

A plurality of the votes cast (the choice of one year, two years or three years receiving the highest number of votes will be approved) |

|

ONE YEAR |

Approval of an amendment of our Amended and Restated Certificate of Incorporation (the "Certificate") to declassify the Board of Directors |

|

Supermajority (662/3%) of shares entitled to vote |

|

FOR |

Approval of an amendment of the Certificate to eliminate the supermajority voting requirements |

|

Supermajority (662/3%) of shares entitled to vote |

|

FOR |

Our Corporate Governance Policies Reflect Best Practices| | | |

Greater than 80% of directors are independent | | | Third-party anonymous ethics reporting hotline | |

| Independent Chairman of the Board of Directors | | | Frequent engagement by management with institutional stockholders | |

| All members of the Compensation Committee, the Audit Committee and the Nominating and Corporate Governance Committee are independent | | | Executive sessions of non-management directors at each Board meeting | |

| Robust director and executive officer stock ownership guidelines | | | Independent compensation consultant | |

| No hedging or pledging permitted by executive officers and directors | | | Compensation policies and programs that discourage excessive risk-taking | |

| Annual Board and committee self-assessments | | | Board oversight of risk and risk management | |

See

"Board“Board of Directors and Corporate

Governance"Governance” in the proxy statement for more details regarding our corporate governance practices.

The Board and the Nominating and Corporate Governance Committee are committed to ensuring the Board functions effectively and with appropriate diversity and expertise, including women and minorities. Accordingly, as of the date of this proxy statement, and assuming the individuals nominated to serve on the Board are elected to the Board at the Annual Meeting, 25% of our directors are women or minorities.

We believe that maintaining positive relationships with our stockholders is critical to our long-term success. We value the views of our stockholders, and we solicit stockholder input regarding our company throughout the year. Additionally, we participate in various investor conferences throughout the year, such as the

Goldman Sachs Global Staples Forum and the Barclays Global Consumer Staples Conference. In

addition, from time to time, primarily after our quarterly earnings press release has been issued, our management participates in various investor meetings coordinated by various “sell side” analysts. In fiscal year

2019,2020, Company representatives were in contact with

the majoritymost of our top

2025 stockholders representing approximately

75%65% of our total shares outstanding to discuss many aspects of our business, including financial and marketplace performance, governance structure, executive compensation and diversity initiatives.

In part due to our stockholder outreach and engagement discussions, the Board approved, and recommends the stockholders approve at the Annual Meeting, the declassification of the Board (See2

1225 17Proposal Five: Approval of an Amendment of the Certificate to Declassify the Boardth) and the elimination of the supermajority approval provisions in our Amended and Restated Certification of Incorporation (SeeProposal Six: Approval of the Amendment to the Certificate to Eliminate the Supermajority Voting Requirements).

Table of Contents

1225 17th Street, Suite 1000

Denver, Colorado 80202

(303) 633-2840

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Information About Attending the Annual Meeting

The 20202021 Annual Meeting of Stockholders (the "Annual Meeting"“Annual Meeting”) of The Simply Good Foods Company (the "Company," "Simply“Company,” “Simply Good Foods," "we," "us"” “we,” “us” or "our"“our”) will be held on Wednesday,Thursday, January 22, 2020, at 9:00 a.m. (ET), at The Ritz-Carlton Golf Resort, 2600 Tiburon Drive, Naples, FL 34109. The telephone number for the Annual Meeting location is (239) 593-2000. The doors to the meeting room will open for admission21, 2021, at 9:00 a.m. (ET). DirectionsIn light of the coronavirus (COVID-19) outbreak and to support the health and well-being of our directors, employees, stockholders, and other stakeholders, we have determined that the Annual Meeting will be held entirely online via audio webcast, with no physical in-person meeting. Stockholders will be able to participate in, vote, view the list of stockholders of record and submit questions from any location are postedvia the internet by visiting www.virtualshareholdermeeting.com/SMPL2021 and entering your 16-digit control number included on our website located atwww.thesimplygoodfoodscompany.comthe proxy card, voting instruction form or Notice (as defined below). ThisOur proxy statementmaterials will first be made available to stockholders on or about December [ 10, 2020.· ], 2019. Proof of stock ownership and some form of government-issued photo identification (such as a valid driver's license or passport) will be required for admission to the Annual Meeting.

Only stockholders who owned Simply Good Foods'Foods’ common stock as of the close of business on November 25, 20192020 (the "Record Date"“Record Date”) will be entitled to attend, vote and votesubmit questions all virtually at our Annual Meeting. To log in, stockholders (or their authorized representatives) will need the Annual Meeting.control number provided on their proxy card, voting instruction form or Notice. If you are not a stockholder or do not have a control number you will not be able to participate.

To attend and participate in the virtual Annual Meeting, stockholders of record as of the Record Datewill need to visit www.virtualshareholdermeeting.com/SMPL2021 (the “Annual Meeting Website”) and you plan to attend the Annual Meeting in person and to vote in person at the Annual Meeting, please save youruse their 16-digit control number found on their proxy card, and bring it to the Annual Meeting as your admission ticket.voting instruction form or Notice. If you plan to attend the Annual Meeting but your shares are held in “street name,” you should contact your broker, bank, trustee or other nominee or custodian to obtain your 16-digit control number or otherwise vote through the broker, bank, trustee or other nominee or custodian. The Annual Meeting webcast will begin promptly at 9:00 a.m. (ET). We encourage you to access the Annual Meeting prior to the start time. Online check-in will begin at 8:45 a.m. (ET) and you should allow ample time for the check-in procedures. The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure that they have a brokerage account, you must bring evidencestrong Internet connection wherever they intend to participate in the Annual Meeting.

Participants should also give themselves plenty of time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting. Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, as of November 25, 2019, which youare posted at the Annual Meeting Website. You may obtain from your bank, stockbroker or other adviser, to be admitted tovote during the Annual Meeting by following the instructions available on the Annual Meeting Website during the Annual Meeting. No cameras, recording devices or large packagesAssistance with questions regarding how to attend and participate via the Internet will be permittedprovided at the Annual Meeting Website on the day of the Annual Meeting.

To enable an orderly and efficient meeting, we are encouraging stockholders to submit questions in the meeting room. Under appropriate circumstances, we may provide assistance or a reasonable accommodation to attendeesadvance of the Annual Meeting at www.proxyvote.com using the same 16-digit control number. Stockholders as of our record date who require assistanceparticipate in our Annual Meeting at www.virtualshareholdermeeting.com/SMPL2021 will also have an opportunity to gain access tosubmit written questions

live via the internet during a designated portion of the Annual MeetingMeeting. In order to do so, stockholders must have available their control number provided on their proxy card, voting instruction form or Notice. While management will be available to receive communications madeanswer questions, management will not be making a formal presentation on the general state of our business at the Annual Meeting. Questions pertinent to Annual Meeting matters will be answered during the Annual Meeting, subject to time constraints. Questions regarding personal matters, including those related to employment, product issues, or suggestions for product innovations, are not pertinent to Annual Meeting matters and therefore will not be answered. Any questions pertinent to Annual Meeting matters that cannot be answered during the Annual Meeting due to time constraints will be posted online and answered on the Investor section of our corporate website, located at www.thesimplyfoodgoodscompany.com. The questions and answers will be available as soon as practical after the Annual Meeting and will remain available until one week after posting.

We will have technicians ready to assist you with any technical difficulties you may have accessing the Annual Meeting Website. If you

would like to request such assistanceexperience technical difficulties during the check-in process or

accommodation,during the Annual Meeting, please

contact us at (303) 633-2840 or at The Simply Good Foods Company, 1225 17th Street, Suite 1000, Denver, Colorado 80202. Please note that we may not be able to accommodate all requests.call the technical support number posted on the Annual Meeting Website.

Information About this Proxy Statement

Why You Received this Proxy Statement. You have received these proxy materials because our Board of Directors (the "Board"“Board”) is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (the "SEC"“SEC”) and is designed to assist you in voting your shares. Availability of Proxy Statement and Annual Report. Pursuant to SEC rules, we have elected to provide access to this proxy statement and our Annual Report for the fiscal year ended August 31, 201929, 2020 (the "Annual Report"“Annual Report”) via the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the "Notice"“Notice”) to our stockholders entitled to notice of, and to vote at, the Annual

Table of Contents

Meeting and at any postponement or adjournment thereof. The Notice is first being mailed to stockholders beginning on or about December [ · ], 2019.10, 2020. Stockholders will have the ability to access the proxy materials atwww.proxyvote.com or request to receive a printed set of the proxy materials by mail or an electronic set of materials by email. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Stockholders can vote

in person at the Annual Meeting

via the Annual Meeting Website or by proxy. There are three ways to vote by proxy:

•

By Telephone—Telephone — Stockholders who received a proxy card by mail and are located in the United States can vote by telephone by calling the phone number, and following the instructions, on the proxy card;

•

•By Internet—YouInternet — Before the Annual Meeting you can vote overby going to www.proxyvote.com until 11:59 p.m. Eastern Time on January 20, 2021. During the Internet atAnnual Meeting you can vote by going to www.proxyvote.comwww.virtualshareholdermeeting.com/SMPL2021;; or

•

•By

Mail—Mail — If you received your proxy materials by mail, you can vote by mail by signing, dating and mailing the enclosed proxy card.

Telephone and Internet voting facilitiesat www.proxyvote.com for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. (ET)Eastern Time on January 21, 2020.20, 2021. We encourage you to submit your proxy as soon as possible (by telephone, Internet or by mail) even if you plan to attend the Annual Meeting in person.Meeting.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record as to how to vote your shares. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting may also be offered to stockholders owning shares through certain banks and brokers. If your shares are held in a brokerage account—

account — meaning they

are not registered in your own

name—name — and you plan to vote your shares

in person at the Annual Meeting, you will only be able to vote

in person at the Annual Meeting if you contact your broker or agent to obtain a legal proxy or

broker'sbroker’s proxy card

and bring it with

youyour 16-digit control number which is required to

vote during the Annual Meeting.

Please note that if you hold your shares through a broker, your broker cannot vote your shares on Proposal 1, the election of directors

and Proposal 3, the advisory vote to approve the compensation of our named executive officers,

Proposal 4, the advisory vote to approve the frequency for future advisory votes to approve, on an advisory basis, the compensation of our named executive officers, Proposal 5, the approval of the amendment to our Amended and Restated Certificate of Incorporation (the "Certificate") to declassify the Board, and Proposal 6, the approval of an amendment to the Certificate to eliminate the supermajority voting requirements, unless you have given your broker specific instructions as to how to vote. In order for your vote to be counted, please make sure that you submit your vote to your broker.

If you vote by proxy, the individuals named on the proxy card (your

"proxies"“proxies”) will vote your shares in the manner you indicate. You may specify whether your shares should be voted, with respect to Proposal 1,

"FOR"“FOR” or

"WITHHOLD"“WITHHOLD” all, any or none of the nominees for director

and with respect to Proposal 2

and Proposal 3,

Proposal 5 and Proposal 6, "FOR," "AGAINST"“FOR,” “AGAINST” or

"ABSTAIN," and, with respect to Proposal 4, "ONE YEAR," "TWO YEARS," "THREE YEARS" or "ABSTAIN."“ABSTAIN.” If you sign and return the proxy card without indicating your instructions, your shares will be voted as follows:

•

"FOR"“FOR” the election of each of the Class IIII nominees for director set forth in Proposal 1;One;

•

Table of Contents•"FOR"“FOR” Proposal 2,Two, relating to the ratification of the appointment of Deloitte & Touche LLP ("Deloitte & Touche"(“Deloitte”) as our independent registered public accounting firm for our fiscal year ending August 29, 2020 ("2021 (“fiscal year 2020"2021”);

•

•"FOR"“FOR” Proposal 3,Three, relating to the approval, on an advisory basis, of the compensation of our named executive officers;

•"ONE YEAR" for Proposal 4, relating to the approval, on an advisory basis, of a frequency of one year for future advisory votes to approve, on an advisory basis, the compensation of our named executive officers;

•"FOR" Proposal 5, relating to the approval of an amendment of our Certificate to declassify the Board (the "Declassification Proposal");

•"FOR" Proposal 6, relating to the approval of an amendment to the Certificate to eliminate the supermajority voting requirements (the "Supermajority Voting Removal Proposal"); and

•

•For or against any other matter properly presented before the Annual Meeting, in the discretion of the proxies.

Each share of our common stock is entitled to one vote. As of the Record Date, there were

95,416,77295,720,637 shares of our common stock outstanding. Votes may not be cumulated in the election of directors.

You may revoke or change your proxy before the Annual Meeting for any reason by (1) if you are a registered stockholder (or if you hold your shares in "street name"“street name” and have contacted your broker, bank, trustee or other nominee or custodian to obtain a proper legal proxy fromor broker’s proxy and your broker)16-digit control number), voting in person at the Annual Meeting via the Annual Meeting Website, (2) submitting a later-dated proxy, either by telephone or online (your last vote prior to 11:59 p.m. (ET) on January 21,20, 2020 will be counted), or (3) sending a written revocation that is received before the Annual Meeting to the Corporate Secretary of The Simply Good Foods Company, c/o The Simply Good Foods Company, 1225 17th17th Street, Suite 1000, Denver, Colorado 80202. Attendance at the Annual Meeting will not, by itself, revoke a duly executed proxy. A quorum is necessary to hold a valid meeting. The holders of a majority in voting power of the outstanding capital stock entitled to vote at the Annual Meeting, present in person, including by means of remote communication, or represented by proxy, shall constitute a quorum. Abstentions and broker "non-votes"“non-votes” are counted as present for purposes of determining whether a quorum exists. A broker "non-vote"“non-vote” occurs when a bank or broker holding shares for a beneficial owner does not vote on a proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Banks and brokers will have discretionary voting power for the ratification of the appointment of Deloitte as our independent registered public accounting firm for fiscal year 20202021 (Proposal 2), but not for voting on the election of the Class IIII director nominees (Proposal 1), or voting on the approval, on an advisory basis, of the compensation of our named executive officers (Proposal 3), voting on the frequency for future advisory votes to approve, on an advisory basis, the compensation of our named executive officers (Proposal 4), voting on the approval of the amendment of the Certificate to declassify the Board (Proposal 5), or voting on the approval of the amendment of the Certificate to eliminate supermajority voting requirements (Proposal 6).

Table of Contents

Required Votes for Action to be Taken

The following table summarizes the votes required for passage of each proposal and the effect of abstentions and uninstructed shares held by brokers.

| Proposal | | | | | | | | |

Proposal | | Vote Required | | | | | Effect of

Abstentions | | | | | Effect of Broker

Non-Votes | |

|---|

1. | |

Election of the four Class IIII director nominees | | | A plurality of the votes cast (the four nominees receiving the highest number of "FOR"“FOR” votes cast will be elected) | | | No effect | | | No effect | |

2. |

|

Ratification of the appointment of Deloitte as our independent registered public accounting firm for fiscal year 20202021 |

|

| Majority of shares present in person, including by means of remote communication, or represented by proxy and entitled to vote |

|

| Same as a vote "Against"

“Against” |

|

| Voted in the broker's broker’s

discretion | |

3. |

|

Advisory vote to approve the compensation of our named executive officers |

|

| Majority of shares present in person, including by means of remote communication, or represented by proxy and entitled to vote |

|

| Same as a vote "Against"

“Against” |

|

| No effect |

4. |

|

Advisory vote to approve the frequency of future advisory votes to approve the compensation of our named executive officers |

|

A plurality of the votes cast (the choice of one year, two years or three years receiving the highest number of votes will be approved) |

|

No effect |

|

No effect |

5. |

|

Approval of an amendment of the Certificate to declassify the Board |

|

Supermajority (662/3%) of shares entitled to vote |

|

Same as a vote "Against" |

|

Same as a vote "Against" |

6. |

|

Approval of an amendment of the Certificate to eliminate the supermajority voting requirements |

|

Supermajority (662/3%) of shares entitled to vote |

|

Same as a vote "Against" |

|

Same as a vote "Against" |

Brokers and custodians cannot vote uninstructed shares on your behalf for Proposal 1 Proposal 3, Proposal 4, Proposal 5 or Proposal 6. In order for3. For your vote to be counted, you must submit your voting instruction form to your broker or custodian.custodian or vote at the Annual Meeting via the Annual Meeting Website. Other Business to be Considered

Our Board does not intend to present any business at the Annual Meeting other than the proposals described in this Proxy Statement and knows of no other matters that are likely to be brought before the Annual Meeting. However, if any other matter properly comes before the Annual Meeting, your proxies will act on such matter in their discretion.

Table of Contents

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Overview

We are dedicated to creating long-term stockholder value. It is our policy to conduct our business with integrity and with an unrelenting passion for providing value to our customers and consumers. All of our corporate governance materials, including our code of ethics, our corporate governance guidelines, and the charters adopted by the Audit, Compensation and Nominating and Corporate Governance Committees, are published under the "Corporate Governance"“Corporate Governance” section within the "Investors"“Investors” portion of our website atwww.thesimplyfoodgoodscompany.com. Information on our website does not constitute part of this proxy statement. Our Board regularly reviews these materials, Delaware law, Nasdaq listing standards and SEC rules and regulations, as well as best practices suggested by recognized governance authorities, and modifies our corporate governance materials as warranted.

We were formed on March 30, 2017 to consummate a business combination between Conyers Park Acquisition Corp.

("(“Conyers

Park"Park”) and NCP-ATK Holdings, Inc.

("Atkins"(“Atkins”), which occurred on July 7, 2017 (the

"Business Combination"“Business Combination”). As a result of the Business Combination, Simply Good Foods owns all of the equity interests of Atkins. Certain aspects of our corporate governance, described in more detail below, were established as part of the Business Combination.

Board of Directors

In accordance

After engaging with our Certificate, ourstockholders early in fiscal year 2019, the Board is currently divided into three classes with staggered three-year terms.determined it was in the best interests of stockholders to execute an orderly wind down of its classified Board structure. At eachthe 2020 annual meeting of stockholders, our stockholders approved a proposal for de-classification of the successorsBoard by the 2023 annual meeting of stockholders. As part of that approval, we amended and restated our certificate of incorporation (our “Certificate”), and all directors elected at and after the Annual Meeting, including the

nominees listed below who are standing for re-election or election to directors whose terms then expirethe Board, will be elected for one-year terms. As part of the de-classification process, the Class III Directors elected at the 2020 annual meeting of stockholders, and any directors who may be elected by the Board to replace any of those directors, will continue to serve fromfor the time of election and qualificationrespective three-year terms until the third2023 annual meeting following election. of stockholders.

Except as otherwise provided by law and subject to the terms of the investor rights agreement (the

"Investor“Investor Rights

Agreement"Agreement”) entered into between the Company and Conyers Park Sponsor, LLC

("(“Conyers Park

Sponsor"Sponsor”), and any other rights of any class or series of preferred stock that may be issued in the future, vacancies on our Board (including a vacancy created by an increase in the size of the Board) may be filled only by the remaining directors. See

"Certain“Certain Relationships and Related Person

Transactions—Transactions — Investor Rights

Agreement"Agreement” below for additional information on certain director nomination rights.

Our directors are currently divided among the three classes as follows:

•

the Class I directors are Joseph E. Scalzo, Robert G. Montgomery, Arvin H. Kash and James D. White, with terms expiring at the annual meeting of stockholders to be held in 2021;

•

•the Class II directors are Clayton C. Daley, Jr., James E. Healey, Nomi P. Ghez and David W. Ritterbush, with terms expiring at the annual meeting of stockholders to be held in 2022; and

•

•the Class III directors are James M. Kilts, David J. West, Michelle P. Goolsby and Brian K. Ratzan, with terms expiring at the Annual Meeting.

After engaging with stockholders early in fiscal year 2019, the Board determined it was in the best interests of stockholders to execute an orderly wind down of the classified Board structure.

A classified Board was established through the Business Combination. The Board recognizes a classified Board can benefit stockholders in a variety of ways, including, among others, promoting continuity and stability of the Board and encouraging directors to take a long-term perspective. However, the Board on its own initiative has also considered

Our Corporate Governance Guidelines provide that a classified Board structuredirector shall not be eligible to stand for reelection if that director reaches or will reach their 78th birthday prior to the next director election for the class in which the director serves. A director, however, may haveserve out the effect of reducingcurrent term following the accountability of directors to stockholders, and recognizes the benefit of providing stockholders an annual opportunity to express their satisfaction or dissatisfaction with the actions of the Board. In addition, the Board believes it78th birthday. As a result, Mr. Arvin H. Kash, who is importanta Class I director will not be standing for it to maintain stockholder confidence by demonstrating that it is responsive and accountable to stockholders and committed to strong corporate governance.

Table of Contents

As described in more detail below, Proposal 5 would approve the de-classification of the Board by the 2023 annual meeting. More specifically,re-election at the Annual Meeting, we are asking you to approve an amendmentand as described below under “Proposal One: Election of our Certificate to declassify our Board. If this proposal is approved, we will amend and restate our Certificate accordingly, and all directors elected at and after our annual meeting held in 2021 will be elected for one-year terms. Directors, elected prior to the 2021 annual meeting, and any directors who may be elected by” the Board upon recommendation of the Nominating and Corporate Governance Committee has nominated Mr. Joseph J. Schena as a Class I director nominee to replace any of those directors, will continue to servefill the vacancy created by Mr. Kash not standing for the respective three-year terms for which they were elected.

re-election.

Nasdaq listing standards require that a majority of our Board be independent. An

"independent director"“independent director” is defined generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which in the opinion of our Board, would interfere with the

director'sdirector’s exercise of independent judgment in carrying out the responsibilities of a director. Our Board conducts an annual assessment of the independence of each member of our Board, taking into consideration all relationships between the Company and/or our officers, on the one hand, and each director on the other, including the

director'sdirector’s commercial, economic, charitable and family relationships, and such other criteria as our Board may determine from time to time.

Our Board has determined that Mss. Ghez and Goolsby and Messrs. Kilts, West, Daley, Healey, Kash, Montgomery, White and Ratzan are

"independent directors"“independent directors” and Mr. Schena will also be an “independent director,” if elected, as defined in the Nasdaq listing standards and applicable SEC rules. In making its independence determinations, the Board considered whether any of the directors was or is a party to certain types of relationships and transactions. See

"—“— Review of Related Person

Transactions"Transactions” below. Joseph E. Scalzo and David W. Ritterbush were each determined not to be an independent director because Mr. Scalzo currently serves as our President and Chief Executive Officer and Mr. Ritterbush

servesformerly served as President of our Quest Nutrition, LLC subsidiary.

Board Leadership Structure

Our Board does not have a formal policy requiring the separation of the roles of Chief Executive Officer and Chairperson of the Board. The Board believes it is in our best interests to make that determination based on circumstances from time to time. Currently, our Chairman of the Board is not an officer of the Company. The Chairman of the Board chairs the meetings of our Board and meetings of our stockholders, with input from the Vice Chairman and the Chief Executive Officer. The Vice Chairman works with the

Chief Executive Officer to develop and gain approval from the Board of our growth strategy and works with the Chief Executive Officer and

the Chief Financial Officer in coordinating our activities with key external stakeholders and parties. These activities include corporate governance matters, investor relations, financing and mergers and acquisitions.

Our Board believes that our current leadership structure and the composition of our Board protect stockholder interests and provide adequate independent risk management and other oversight of our business, while also providing outstanding leadership and direction for our Board and management. More than a majority of our current directors are

"independent"“independent” under Nasdaq standards, as more fully described above.

The independent directors of the full Board, and each Board committee (of which all are comprised of independent directors), meet in executive sessions, without management present, during each regularly scheduled Board or committee meeting and are very active in the oversight of the Company. Each independent director has the ability to add items to the agenda for Board meetings or raise subjects for discussion that are not on the agenda for that meeting. In addition, our Board and each Board committee has complete and open access to any member of management and the authority to retain independent legal, financial and other advisors as they deem appropriate.

Table of Contents

Annual Evaluations of the Board and Board Committees; New Board Member Orientation

Each year, through the Nominating and Corporate Governance Committee, the Board and each Board committee conducts self-evaluations to assess their respective performances and consider potential areas of improvement. The assessments focus on the effectiveness of the Board and each Board committee, assessed against their respective responsibilities as set forth in the

Board'sBoard’s Governance Guidelines and each committee charter. Directors consider matters such as fulfillment of the

Board'sBoard’s and their individual primary responsibilities, effectiveness of discussion and debate at meetings, the quality and timeliness of Board and Board committee materials and presentations, the composition of the Board and each Board committee (including experience, skills and independence of members), and effectiveness of the

Board'sBoard’s and each Board

committee'scommittee’s processes. Responses are reviewed and shared with the Chairman of the Board and the chairs of the respective Board committees, and appropriate responsive actions considered as necessary.

We conduct an orientation program for new directors as soon as practical following their joining the Board. This orientation includes presentations and written information to familiarize new directors with our corporate governance, strategic plans, financial reporting, principal officers, auditing processes, risk assessment and such other topics as the Board and/or the

CEOChief Executive Officer feel are appropriate.

Review of Related Person Transactions

Our Audit Committee must review and approve any related person transaction

into which we

enter into.enter. The Audit

Committee'sCommittee’s charter and our Related Party Transactions Policy detail the policies and procedures relating to transactions that may present actual, potential or perceived conflicts of interest and may raise questions as to whether such transactions are consistent with the best interest of us and our stockholders.

A summary of these policies and procedures follows. Any potential related party transaction that is brought to the Audit

Committee'sCommittee’s attention will be analyzed by the Audit Committee, in consultation with outside counsel or members of management, as appropriate, to determine whether the transaction or relationship does, in fact, constitute a related party transaction. At its meetings or in the interim as necessary, the Audit Committee will be provided with the details of each new, existing or proposed related party transaction, including the terms of the transaction, the business purpose of the transaction and the benefits to us and to the relevant related party.

In determining whether to approve a related party transaction, the Audit Committee must consider to the extent relevant, among others, the following factors:

•

whether the terms of the transaction are fair to us and on the same basis as would apply if the transaction did not involve a related party;

•

•whether there are business reasons for us to enter into the transaction;

•

•whether the transaction would impair the independence of an outside director;

•

•whether the transaction would present an improper conflict of interest for any director or executive officer; and

•

•any pre-existing contractual obligations.

Any member of the Audit Committee who has an interest in the transaction under discussion must abstain from any voting regarding the transaction, but may, if so requested by the Chairman of the Audit Committee, participate in some or all of the Audit Committee'sCommittee’s discussions of the transaction. Upon completion of its review of the transaction, the Audit Committee may determine to permit or to prohibit the transaction.

Table of Contents

Role of the Board in Risk Oversight

Members of the Board have an active role, as a whole and also at the Board committee level, in overseeing management of the

Company'sCompany’s risk. While the Board is ultimately responsible for overall risk oversight at our Company, our three Board committees assist the full Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee has primary responsibility for reviewing and discussing the

Company'sCompany’s policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which the

Company'sCompany’s exposure to risk is handled, and for monitoring the

Company'sCompany’s major financial risk exposures and the steps the Company has taken to monitor and control such exposures. In connection with its risk assessment and management responsibilities, the Audit Committee oversees risks related to food safety, cybersecurity and other risks relevant to our computerized information system controls and security. The Audit Committee also is charged with overseeing risks with respect to our Related Party

TransactionTransactions Policy as noted above, and with any potential conflicts of interest with directors and director nominees. The Compensation Committee is charged with ensuring that our compensation policies and procedures do not encourage risk taking in a manner that would have a material adverse

impacteffect on the Company. The Nominating and Corporate Governance Committee is charged with overseeing the process of conducting management succession planning and management

development.development and evaluating environmental, social and governance (“ESG”) matters that are relevant and material to us. Each Committee reports its findings to the full Board for consideration.

Communications with the Board

If stockholders or other interested parties wish to contact any member of our Board, they may write to the Board or to an individual director in care of the Corporate Secretary at The Simply Good Foods Company, 1225 17th17th Street, Suite 1000, Denver, Colorado 80202; or through our third-party ethics and compliance reporting website atSimplyGoodFoods.Ethicspoint.com. Relevant communications will be distributed to the Board, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unrelated to the duties and responsibilities of the Board will not be forwarded, such as business solicitations or advertisements, junk mail, mass mailings and spam, new product suggestions, product complaints or inquiries, resumes and other forms of job inquiries, or surveys. In addition, material that is threatening, illegal or similarly unsuitable will be excluded. Any communication that is screened as described above will be made available to any director upon his or her request. Process for Recommending or Nominating Potential Director Candidates

Subject to certain investor rights under the Investor Rights Agreement, the Nominating and Corporate Governance Committee, with the input of the Chief Executive Officer, is responsible for recommending nominees for Board membership to fill vacancies or newly created positions, and for recommending the persons to be nominated for election at the Annual Meeting. In connection with the selection and nomination process, the Nominating and Corporate Governance Committee reviews the desired experience, skills, diversity and other qualities to ensure appropriate Board composition, taking into account the current Board members and the specific needs of the Company and the Board. In connection with the process of

nominating¾Gnominating incumbent directors for re-election to the Board, the Nominating and Corporate Governance Committee also considers the

director'sdirector’s tenure on and unique contributions to the Board.

The Nominating and Corporate Governance Committee continually reviews Board composition and potential additions while striving to maintain and grow a diverse and broad skill set that complements the business. The Nominating and Corporate Governance Committee has adopted nominating criteria guidelines that include understanding operations, marketing, finance or other aspects relevant to the success of a publicly traded company in

today'stoday’s business environment, with broad experience in relevant disciplines. The Nominating and Corporate Governance Committee may consider certain factors related specifically to our business, including, but not limited to:

•

knowledge of consumer-packaged goods/food products industries, particularly in branded food, nutrition and snacking, but principally in industries oriented to consumer products;

•

•accounting or related financial management expertise;

•

•experience executing growth and merger and acquisition strategies, to support the strategic plan for the Company;

•

•international exposure and diversity of cultural background and experience with global markets, because the Company operates in a number of countries;

•

•leadership experience at an executive level with understanding of the development and implementation of strategies; and

•

•high-level marketing and social media experience.

The Nominating and Corporate Governance Committee has not assigned specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. In the evaluation of potential new candidates, the Nominating and Corporate Governance Committee considers each

candidate'scandidate’s qualifications in light of the then-current mix of Board attributes, including diversity. Continuing directors are evaluated by the Nominating and Corporate Governance Committee in the same way, including the continuing

director'sdirector’s past contributions to the Board in such evaluation.

Although the Board does not have a formal policy specifying how diversity of background and personal experience should be applied in identifying or evaluating director candidates, to help ensure that the Board remains aware of and responsive to the needs and interests of our customers, stockholders, employees and other stakeholders, the Board believes it is important to identify qualified director candidates

thatwho would increase the gender, racial, ethnic and/or cultural diversity of the Board.

Similarly, we believe a Board made up of highly qualified individuals from diverse backgrounds is important to the success of the business, in addition to promoting better corporate governance and performance and effective decision-making. Accordingly,

when evaluating the current directors and considering the nomination of new directors, the Nominating and Corporate Governance Committee makes an effort

when nominating new directors to ensure

that the composition of the Board reflects a broad diversity of experience, profession, expertise, skill, and background, including gender, racial, ethnic, and/or cultural diversity. Consistent with the

Board'sBoard’s goal of enhancing the

Board'sBoard’s diversity of experience, skills, and background, the Board appointed Ms. Goolsby and Mr. White to the Board in

2019.2019 and the Board believes these directors have provided valuable experience and insight, along with additional diversity to the Board. The Board and the Nominating and Corporate Governance Committee are committed to ensuring the Board functions effectively and with appropriate diversity and expertise, including women and minorities. Accordingly, as of the date of this proxy statement, and assuming Mr. Schena is elected to the Board, 25% of our directors were women or minorities. Nominees are not discriminated against on the basis of race, religion, national origin, disability or sexual orientation. The Board and the Nominating and Corporate Governance Committee are committed to continue to seek female and minority candidates to join the Board.

Although the Board does not have a formal policy regarding director candidates recommended by stockholders, stockholders may recommend individuals to the Board for nomination and also have the right under our Bylaws to nominate directors, which is why the Board believes it is appropriate not to have such a policy. Stockholders may recommend individuals to the Board for consideration as potential director candidates by submitting

candidates'candidates’ names, appropriate biographical information (including age, business address and residence address, principal occupation or employment and relevant experience), the class or series and number of shares of capital stock of the Company which are directly or indirectly owned beneficially or of record by the candidate, the date such shares were acquired and the investment intent of such acquisition and any other information relating to the

Table of Contents

candidate that would be required to be disclosed in a proxy statement or other similar filing to our principal executive offices at:

Corporate Secretaryc/o The Simply Good Foods Company1225 17th17th Street, Suite 1000Denver, Colorado 80202 Assuming the appropriate information has been provided, the Board will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. If the Board determines to nominate a stockholder-recommended candidate and recommends his or her election to the Board, then his or her name will be included in the proxy statement for the next annual meeting of stockholders.

In order for stockholders to nominate director candidates under our Bylaws, our Bylaws require that we be given advance written notice of stockholder nominations for election to the Board. Such nomination must contain the information required by our Bylaws with respect to the nominee and the stockholder. To be timely, a stockholder'sstockholder’s notice must be delivered to our Corporate Secretary, in the case of an annual meeting, not earlier than the 120th120th day and no later than the 90th90th day prior to the first anniversary of the date of the preceding year'syear’s annual meeting. After engaging with stockholders early in fiscal year 2019, the Board determined it was in the best interests of stockholders to amend our Certificate to eliminate the supermajority voting requirements contained in the Certificate. Our stockholders approved this amendment at the 2020 annual meeting of stockholders.

Succession Planning and Management Development

The Board supports the development of the

Company'sCompany’s executive talent, especially the Chief Executive Officer and the senior leaders of the Company, because continuity of strong leadership at all levels of the Company is part of the

Board'sBoard’s mandate for delivering strong performance to stockholders. To further this goal, the executive talent development and succession planning process is overseen by the Nominating and Corporate Governance Committee pursuant to its charter. The Nominating and Corporate Governance Committee is charged with developing and recommending to the Board the approval of an executive officer succession plan. The Nominating and Corporate Governance Committee is also responsible for implementing the succession plan by developing and evaluating potential candidates for executive positions, and periodically reviewing the succession plan.

The Compensation Committee also indirectly supports the succession planning process through its annual approval of compensation targets and achievement of goals for incentive compensation payments.

Compensation Committee Interlocks and Insider Participation

No member of the Compensation Committee during fiscal year 2019:2020: (i) was, at any time during fiscal year 2019,2020, an officer or employee of Simply Good Foods, (ii) was formerly an officer of Simply Good Foods, other than Mr. West and Mr. Ratzan (Mr. West served as the Chief Executive Officer of Conyers Park and Mr. Ratzan served as the Chief Financial Officer of Conyers Park from its formation in April 2016 until the consummation of the Business Combination in July 2017), or (iii) had any relationship requiring disclosure by Simply Good Foods under Item 404 of Regulation S-K. No executive officer of Simply Good Foods during fiscal year 20192020 served as a member of the compensation committee (or other board committee

performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, or as a director of another entity, where one of the other entity'sentity’s executive officers served on the Compensation Committee of Simply Good Foods or as a director of Simply Good Foods.

Table of Contents

Anti-Hedging and Pledging Policy

Our Insider Trading Policy prohibits our officers, directors and all other employees from (i) pledging any of our securities as collateral for a loan, (ii) holding our securities in a margin account, (iii) engaging in short sales, (iv) buying or selling put or call positions or other derivative positions in our securities, and (v) entering into hedging or monetization transactions or similar arrangements with respect to our securities.

We maintain a Code of Ethics that applies to all of our directors, executive officers and employees. Our Code of Ethics is posted on our corporate website atwww.thesimplygoodfoodscompany.com and can be accessed by clicking on the "Investors"“Investors” link followed by the "Corporate Governance"“Corporate Governance” link. Any amendments to or waivers of our Code of Ethics relating to our directors or executive officers that is required to be disclosed also will be posted on our website. We have designated our Chief Legal Officer as the compliance officer who oversees our ethics and compliance program and provides regular reports to each of the Audit Committee and the Nominating and Corporate Governance Committee on the program'sprogram’s effectiveness and the status of any reports or complaints made under the Code of Ethics reporting procedures. Director and Executive Officer Stock Ownership Guidelines

Non-Employee Directors Our non-employee directors are required to own commonFor information on our stock equalownership guidelines which apply to four times such director's annual retainer. Directors are expected to satisfy these guidelines within five years of becoming a director and may not sell any common stock until they are in compliance with such guidelines and thereafter only if the guidelines remain satisfied after giving effect to the sale. Each of our non-employee directors are currently in compliance with the stock ownership guidelines or are on track to meet their respective ownership guidelines by the required deadline.

Executive Officers

Our executive officers and other senior leaders are required to own common stock equal to a multiple of their annual base salary, depending on their level as set forth below:

| | |

Position

| | Stock Ownership Guidelines |

|---|

Chief Executive Officer

| | Five Times (5.0x) Base Salary |

Executive Officers, other than Chief Accounting Officer

| | Three Times (3.0x) Base Salary |

Senior Vice Presidents and the Chief Accounting Officer

| | One Time (1.0x) Base Salary |

Executive officers and senior leaders are expected to satisfy these guidelines within five years of assuming their positions and may not sell any common stock until they are in compliance with such guidelines and thereafter only if the guidelines remain satisfied after giving effect to the sale. In instances where the stock ownership guidelines would place a severe hardship, the Compensation Committee will make a final decision as to an alternative stock ownership guideline for such person that reflects both the intention of the guidelines and personal circumstances. Each of our executive officers and senior leaders is currently in compliance with the stock ownership guidelines or is on track to meet the ownership guidelines by the required deadline.

Shares that count towards the ownership guidelines include:

•shares owned directly (or through a nominee);team members, please see “Compensation Discussion and Analysis — Corporate Governance Policies —

•shares beneficially owned in a family trust or by one's spouse or minor children;

Table of Contents

•shares that can be purchased pursuant to vested stock options up to the intrinsic value of the options, where the intrinsic value means the difference between the fair market value of our common stock on the date of measurement and the exercise price of the applicable stock option, multiplied by the number of vested options held; andStock Ownership Guidelines

,” below.•deferred stock units of the company.

Unvested equity awards do not count towards the ownership guidelines.

Recoupment ("Clawback"(“Clawback”) Policy

In July 2019, the Board adopted a clawback policy that applies to certain incentive compensation for our executive officers and other employees paid or awarded after July 2019. The clawback policy provides that in the event of a restatement of the

Company'sCompany’s financial statements as a direct result of material noncompliance with any financial reporting requirements and the Board determines, in its sole discretion, that an executive officer subject to the policy committed an act or omission that gave rise to the circumstances requiring the accounting restatement and which constituted negligence, misconduct, wrongdoing or a violation of any of the

Company'sCompany’s rules or of any applicable legal or regulatory requirements on the part of that executive officer in the course of their employment by, or otherwise in connection with, the Company, then the Board will determine whether the Company should seek to recover any excess incentive compensation received by the employee during the three completed fiscal years immediately preceding the date on which the Company is required to prepare an accounting restatement.

In addition to the provisions described above, should the Board determine, in its sole discretion, that one of our executive officers or other employee subject to the policy committed an act or omission during the course of his or her employment with the Company that gives rise to a material adverse effect on the financial condition or reputation of the Company, and such act or omission constituted (i) willful, knowing or intentional violation of any of the

Company'sCompany’s rules or any applicable legal or regulatory requirements, or (ii) fraud or other illegal conduct, then the Board will determine whether the Company should seek to recover from that employee up to 100% (as determined by the Board in its sole discretion as appropriate based on the conduct involved) of the incentive compensation received by such employee from the Company during the three completed fiscal years immediately preceding the date of the Board becomes aware of such material adverse effect, and not just the excess of what would have been paid to the employee under an accounting restatement as described above.

For purposes of the policy, incentive compensation means any compensation that is granted, earned or vested based wholly or in part on the attainment of a financial reporting or stock price measure determined and presented in accordance with the accounting principles used in preparing the Company'sCompany’s financial statements, including annual bonuses and other short- and long-term cash incentives and equity based awards.

The objectives of our director compensation program are to offer compensation that is competitive with the compensation paid by peer companies so that we may attract and retain qualified candidates for Board service and to reinforce our practice of encouraging stock ownership by our directors. The Compensation Committee regularly reviews the compensation paid to non-employee directors and recommends changes to the Board, as appropriate.

The Board did not make any changes to the compensation of our directors from fiscal year 2018 to the fiscal year ended August 31, 2019 ("29, 2020 (“fiscal year 2019"2020”). In fiscal year 2018, Mercer (US) Inc. ("Mercer"(“Mercer”), the Compensation Committee'sCommittee’s independent compensation consultant, conducted a review of our non-employee director compensation program. The review assessed the competitiveness of our non-employee director compensation relative to a composite of peer companies, which were the same companies as those used by the Compensation Committee to inform its deliberations and determinations for executive compensation (see "Peer Companies"“Peer Companies” in the Compensation,“Compensation Discussion and AnalysisAnalysis” section below). After reviewing the assessment and consultation with Mercer, the Board approved a director compensation program in fiscal year 2018 in line with competitive non-employee director compensation levels of peer companies. Our director compensation program consists of the following:

| | Annual Board Service | | | Cash Retainer | | | | $ | 60,000 | | |

| | | | | Restricted Stock Units(1) | | | | $ | 90,000 | | |

| | Board and Committee Chair Cash

Retainer | | | Chair and Vice Chair of the Board | | | | $ | 25,000 | | |

| | | | | Audit Committee | | | | $ | 10,000 | | |

| | | | | Compensation Committee | | | | $ | 7,500 | | |

| | | | | Nominating & Corporate Governance Committee | | | | $ | 5,000 | | |

| | | | | | |

Annual Board Service | | Cash Retainer | | $ | 60,000 | |

| | Restricted Stock Units(1) | | $ | 90,000 | |

Board and Committee Chair Cash Retainer(1) | | Chair and Vice Chair of the Board | |

$ |

25,000 | |

| | Audit Committee | | $ | 10,000 | |

| | Compensation Committee | | $ | 7,500 | |

| | Nominating & Corporate Governance Committee | | $ | 5,000 | |

(1)(1)- The restricted stock units

("RSUs"(“RSUs”) vest one year from the grant date, subject to such director'sdirector’s continued service as of the vesting date. Each RSU entitles the director to one share of our common stock and will be payable and settled at the time of vesting.

The table below sets forth information concerning the compensation of our non-employee directors who served in fiscal year

2019.2020. In addition to the amounts shown below, we also reimburse directors for travel expenses and other out-of-pocket costs incurred in connection with their attendance at

Table of Contents

meetings. Neither Mr. Joseph Scalzo nor Mr. David Ritterbush, receive separate compensation for their service as director.

| Name | | | Fees Earned

or Paid in Cash

($) | | | Stock Awards

($)(1) | | | Total

($) | |

| James M. Kilts | | | | | 85,000 | | | | | | 89,999 | | | | | | 174,999 | | |

| David J. West | | | | | 85,000 | | | | | | 89,999 | | | | | | 174,999 | | |

| Clayton C. Daley, Jr | | | | | 67,500 | | | | | | 89,999 | | | | | | 157,499 | | |

| Nomi P. Ghez | | | | | 65,000 | | | | | | 89,999 | | | | | | 154,999 | | |

| Michelle P. Goolsby | | | | | 60,000 | | | | | | 89,999 | | | | | | 149,999 | | |

| James E. Healey | | | | | 70,000 | | | | | | 89,999 | | | | | | 159,999 | | |

| Arvin H. Kash | | | | | 60,000 | | | | | | 89,999 | | | | | | 149,999 | | |

| Robert G. Montgomery | | | | | 60,000 | | | | | | 89,999 | | | | | | 149,999 | | |

| Brian K. Ratzan | | | | | 60,000 | | | | | | 89,999 | | | | | | 149,999 | | |

| James D. White | | | | | 60,000 | | | | | | 89,999 | | | | | | 149,999 | | |

| | | | | | | | | | |

Name | | Fees Earned

or Paid in Cash

($) | | Stock Awards

($)(1) | | Total

($) | |

|---|

James M. Kilts | | | 85,000 | | | 89,990 | | | 174,990 | |

David J. West | | | 85,000 | | | 89,990 | | | 174,990 | |

Clayton C. Daley, Jr | | | 67,500 | | | 89,990 | | | 157,490 | |

Nomi P. Ghez | | | 65,000 | | | 89,990 | | | 154,490 | |

Michelle P. Goolsby(2) | | | 12,245 | | | 22,479 | | | 34,724 | |

James E. Healey | | | 70,000 | | | 89,990 | | | 159,990 | |

Arvin H. Kash | | | 60,000 | | | 89,990 | | | 149,990 | |

Robert G. Montgomery | | | 60,000 | | | 89,990 | | | 149,990 | |

Brian K. Ratzan | | | 60,000 | | | 89,990 | | | 149,990 | |

James D. White(3) | | | 6,122 | | | 14,975 | | | 21,097 | |

Former Director: | | |

| | |

| | |

| |

Richard T. Laube(4) | | | 22,418 | | | 89,990 | | | 112,408 | |

(1)(1)- The amounts included under the

"Stock Awards"“Stock Awards” column reflect the aggregate grant date fair value of the RSU awards granted to each director, computed in accordance with Financial Standards Accounting Board ("FASB"(“FASB”) Accounting Standards Codification ("ASC"(“ASC”) Topic 718, excluding the effect of any estimated forfeitures. Information about the assumptions used to calculate the grant date fair value of these awards can be found in Note 1415 to the consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended August 31, 2019.

(2)Ms. Goolsby was appointed to the Board in June 2019.

(3)Mr. White was appointed to the Board in July 2019.

(4)Mr. Laube resigned from the Board, effective January 8, 2019. Upon his resignation, Mr. Laube forfeited the RSUs granted to him in fiscal year 2019.

29, 2020.

The following table presents the number of outstanding RSUs held by each director as of August

31, 2019.29, 2020. None of the directors hold stock options.

| Director | | | | |

Director

| | Number of Shares

Subject to Outstanding

RSUs as of

August 31, 2019(1)29, 2020 | | (1) |

|---|

James M. Kilts | | | 5,033 | | 3,011 | | |

David J. West | | | 5,033 | | 3,011 | | |

Clayton C. Daley, Jr | | | 5,033 | | 3,011 | | |

Nomi P. Ghez | | | 5,033 | | 3,011 | | |

Michelle P. Goolsby | | | 959 | | 3,011 | | |

James E. Healey | | | 5,033 | | 3,011 | | |

Arvin H. Kash | | | 5,033 | | 3,011 | | |

Robert G. Montgomery | | | 5,033 | | 3,011 | | |

Brian K. Ratzan | | | 5,033 | | 3,011 | | |

James D. White | | | 542 | | 3,011 | | |

Except for Ms. Goolsby and Mr. White, the(1)

The RSUs vested in full on September 6, 2019. For Ms. Goolsby and Mr. White, the RSUs vest on June 13, 2020 and July 23, 2020, respectively. Mr. Laube forfeited all of his unvested RSUs upon his resignation from the Board on January 8, 2019.2020.

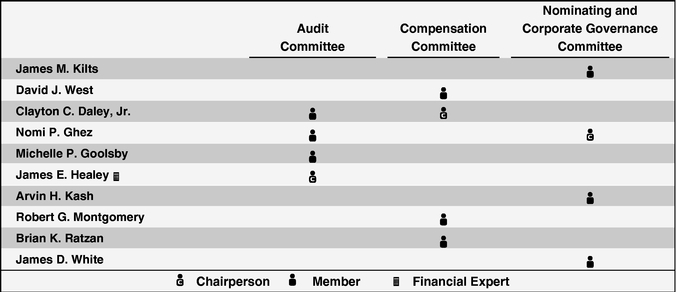

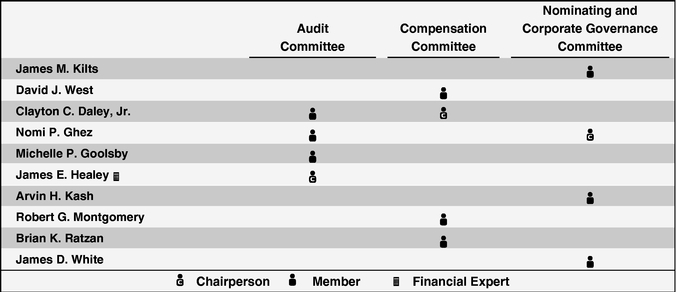

MEETINGS AND COMMITTEES OF THE BOARD

Our Board has established certain standing committees to assist in the performance of its various functions. All Board committee members are appointed by our Board upon recommendation of the Nominating and Corporate Governance Committee, subject to the Investor Rights Agreement.

Our Board has affirmatively determined, upon recommendation of the Nominating and Corporate Governance Committee, that all of the members of our Audit, Compensation and Nominating and Corporate Governance Committees are independent as defined under the Nasdaq listing standards. The Board also has determined that all members of the Audit Committee meet the independence requirements contemplated by the Nasdaq listing standards and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the

"Exchange Act"“Exchange Act”), and, in determining the independence of all members of our Compensation Committee, the Board took into account the additional independence considerations required by the Nasdaq listing rules and Rule 10C-1 of the Exchange Act relating to Compensation Committee service.